You can listen to a professional narration of this article below:

Mr. Market was less than kind to our portfolio over the last few months, and especially the last few weeks. I cannot tell you how little it worries us what Mr. Market thinks about our stocks at any particular point in time. We love* our portfolio even if the Mr. Market doesn’t fancy it today.

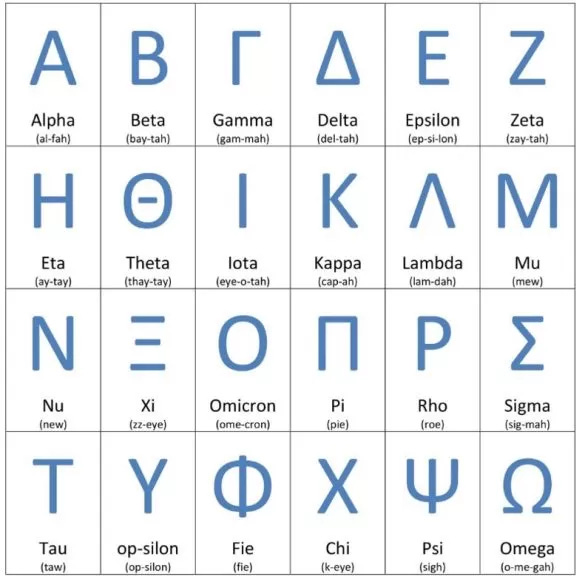

Also, before we take Mr. Market seriously, let us tell you about the rationality of Mr. Market lately. The World Health Organization (WHO) names each variant of the Covid virus by going to the next letter of the Greek alphabet. After Delta, which is currently the most predominant variant of the virus ravaging the world, there must have been nine others that were not important enough because we never heard of them. Why nine? Because when the latest variant of concern was found in South Africa, it emerged that the letter Nu was supposed to be applied to it. But Nu sounds a lot like new. WHO didn’t want to confuse people, so it skipped to the next letter in the Greek Alphabet, which is Xi – oops, that’s the Chinese supreme dictator. So, for the sake of global political stability, that letter was skipped, too.

This brings us to Omicron, the name of the latest variant.

This is where this story gets a bit more interesting.

The one disruption that really puzzles me is the labor shortage. There are millions of jobs going unfilled today. I hear stories of Starbucks stores being closed due to a lack of workers. Every service that has a heavy labor component has gotten worse – be it restaurants, ridesharing, or pharmacies. There happens to be a cryptocurrency, one of thousands, that is also named Omicron. I still cannot grasp the logic behind it, but that cryptocurrency was up 900% on the day the South African variant was christened. There must have been a trading algorithm or a lot of bored investors looking for the next gamble, to drive something seemingly worthless up 900%.

That is the drunken Mr. Market that is pricing our stocks today.

I am going to repeat what you will find me saying several times in the letter: We own businesses that are priced, not valued, by Mr. Market thousands of times a day. We have done a lot of work on each company in the portfolio, and through diligent research we have reached the conclusion that each is worth more than the price it is changing hands at today. Are we going to be right about each and every stock? Of course not. This is a numbers game. But we use a time-tested methodology centered on common sense and the cash flows these businesses generate. Also, this is not our first rodeo. We’ll go on making small tweaks, taking advantage of Mr. Market’s manic-depressive moods, at least when it comes to anything that generates cash flows.

Of course, we could change our investment process and load up on the cryptocurrency called Pi Coin, which happens to take its name from the letter in the Greek alphabet that follows Omicron. But I think we all agree we should stick to our knitting, buying high-quality businesses that are significantly undervalued. (Anyway we already loaded up on pie during Thanksgiving.)

Our advice – enjoy this holiday season. Spend time with your loved ones; don’t look at your portfolio. Let us worry about it – after all, we own the same stocks you do.

We wish you joyful and safe holidays.

*I shared a draft of this letter with some close value investing friends. A few of them politely pointed out that I should not use the word “love” to describe my views towards the portfolio. They are right. Love is almost by definition an irrational emotion. Our view towards stocks we own are not an affection or emotion. In fact, we work relentlessly to extricate emotion out of our process. We look at ourselves as scientists (we would wear white coats to work if we thought we would get away with it and not constantly spill coffee on them).

Our opinion on any company we own is just a thesis that will be validated or invalidated by time. We’d like to invalidate them before time does. So “love” is not the word that I should use to describe what we think of our portfolio, it is a flawed shortcut for saying – we own high quality, significantly undervalued companies that are run by good, sensible management teams.

The Maestro of Context

When I was in college, I took a music appreciation class. Although, luckily, I continued to appreciate classical music after the course was over, I don’t remember learning much about classical music in that class.

Later in life, when I decided that there was a lot more to life than investing, I engrossed myself in learning about classical music. The world of music and its composers and performers is fascinating.

This time around I had much better luck. I stumbled onto the lectures of Robert Greenberg at The Great Courses. Greenberg is an enigma. He is a composer, pianist, lecturer, and a music historian. He is all that, but he is also an incredibly gifted teacher.

Watch this interview with Larry King and you’ll see what I mean.

I remember seven years ago my son Jonah and I were driving back to Denver from a ski trip to Vail. We were listening to Robert’s lecture about Giuseppe Verdi, the godfather of Italian opera. When we arrived home, Jonah did not want to get out of the car; he wanted to finish listening to Robert’s lecture. Jonah was only 13 then, a normal kid who would usually prefer J Cole to a long-dead Italian composer. Robert has an ability that my college teacher lacked: He brings classical music history alive; he makes it fun, accessible, and interesting.

Listening to classical music has made my life so much richer. Yes, richer. As I am writing this I am listening to the second movement of Shostakovich’s Piano Concerto No. 2. The joy it brings me no amount of money can buy.

What Robert Greenberg does through his lectures and writings brings another dimension to music: context. Just as by reading a novel we get a glimpse of the soul of the writer, music gives us a glimpse of the soul and emotions of the composer. Learning about the composer provides a texture that enhances the music-listening experience.

Since I mentioned Shostakovich, in 1932 he composed the opera Lady Macbeth. It was an enormous success, propelling the 26-year-old composer to international stardom. His opera was performed in Moscow and Leningrad (now Saint Petersburg), in the US, and all over Europe. Shostakovich became an international celebrity. But then Joseph Stalin and other members of the Communist Party went to see the opera. They did not care for it, and Stalin wrote a scathing review in Pravda (the Soviet newspaper of record).

Shostakovich wrote:

That article on the third page of Pravda changed my entire existence. It was printed without a signature, like an editorial – that is, it expressed the opinion of the Party. But it actually expressed the opinion of Stalin, and that was much more important.

Shostakovich was cancelled by the party. He went from being a Russian source of pride to an enemy of the state overnight. In Soviet Russia when you got cancelled you became radioactive, as anyone around you became guilty by association of whatever you were accused of. Shostakovich’s life was never the same, and he came close to either being executed or exiled to Siberia. This scared him for the rest of his life. Robert Greenberg wrote a terrific article about Shostakovich’s life – read it here.

Robert Greenberg is truly an American treasure. The pandemic interrupted his recording new lectures on Great Courses (though he told me that he may resume recording new lectures soon), but today he writes weekly articles. You can access a treasure trove of his past articles and podcasts on his site as well.

I never ask my readers for anything, but if you love classical music, if you love learning about it, subscribe to Robert’s articles and then support him on Patreon (you can do it for as little as $5 a month). I am a proud patron of Mr. Greenberg’s work myself.

I don’t like the word support.

When you subscribe to The New Yorker or The Atlantic, you do not think of that subscription as charity or as support – you are paying to receive content. You are paying with your time (that is what money is, stored time) for the time of others. It is a fair exchange of your time for the time others put into the creation of content. This is what Robert Greenberg’s site offers, except that you are avoiding layers of bureaucracy and your money goes directly to the creator of amazing content.

No matter what level of support you choose, you’ll get the better end of the deal.

Vitaliy Katsenelson is the CEO at IMA, a value investing firm in Denver. He has written two books on investing, which were published by John Wiley & Sons and have been translated into eight languages. Soul in the Game: The Art of a Meaningful Life (Harriman House, 2022) is his first non-investing book. You can get unpublished bonus chapters by forwarding your purchase receipt to bonus@soulinthegame.net.

Please read the following important disclosure here.