You can listen to a professional narration of this article below:

This is part one of the winter seasonal letter I wrote to IMA clients, sharing my thoughts about the economy and the market. I tried something I’ve never done before. Instead of conveying my message through storytelling, I tried to compress my thoughts into short sentences. I summarized some 50,000 words into about 1,000 (a compression ratio of 50 to 1!).

The Stock Market, The Economy, Possible Outcomes, How to Invest

The Stock Market

Stock market math: Total returns = earnings per share growth + P/E change + dividends. This formula applies to any stock and any stock market.

Stock market returns over the last 100+ years have followed a pattern: long-term bull markets (15 +/- years) followed by sideways markets (15 +/- years), not bear markets. The Great Depression was the only exception.

Sideways markets, though, have a flat slope consisting of mini bull, bear, and sideways markets – a lot of volatility but no real returns.

If the stock market P/E never changed, stayed at 15x, there would be no market cycles. The stock market would appreciate with earnings growth (4-6% a year) + dividends (4-5% a year).

Human behavior causes and follows a pendulumlike momentum – excitement leads to more excitement (CNBC on all day long) 🡪 bull market. When momentum breaks, stock declines lead to more declines (CNBC off) 🡪 sideways market.

Historically, economic growth was similar during bull and sideways markets. Changes in P/E were the cause of bull and sideways markets.

Bull markets start when P/E is much below average: P/E increase + earnings growth 🡪 high (above-average) returns.

At the end of bull markets P/E stops expanding, stagnates, declines. The expectation of endless nirvana is broken – welcome to sideways markets.

Sideways markets start when P/E is much above average (end of bull market): P/E decline + earnings growth 🡪 low or no returns.

Current valuations: If we normalize for high profit margins, P/Es are very high. P/Es are likely to decline for a long-time.

Low interest rates boosted P/Es; higher interest rates take P/Es down.

Profit margins are likely to decline for several reasons: selective deglobalization (widgets made in Ohio more expensive than ones made in Shanghai), higher interest rates, likely higher taxes.

If we are lucky, we will have a sideways market.

If unlucky, and economy goes into long-term stagnation, we’ll have a secular bear market. The most recent secular bear market was in Japan: Both P/Es and earnings declined for a long time. We are not Japan, but nor was Japan “Japan” in the early 1990s.

The Economy

The economy is still difficult to analyze. It has been impacted by Covid distortions – too much/too little demand, supply chain disruptions, $5 trillion of debt issued by the US government.

Tailwinds: Historically, a bet against the US consumer and US economy was a losing one. The consumer has a lot of pandemic cash. Unemployment is low. The financial/banking system is in great shape from the perspective of reserves and credit quality. Selective deglobalization will bring some jobs to the US.

Major headwind: rising interest rates. The economy is addicted to low interest rates. It will take time and pain to readjust from zero rates to average/above average rates.

Trillions of dollars of long-term, low-coupon debt have been issued, which will bring pain to holders who will be taking realized or unrealized losses. First-, second-, and third-order effects will be surfacing in the financial system. (The Silicon Valley Bank bankruptcy leaps to mind here.)

Corporate debt is at an all-time high – debt paydown will take place at the expense of share buybacks, fewer capital investments, less growth.

Housing market good news: Most mortgages are fixed-rate, not impacted by higher rates. If homeowners don’t move, they don’t feel the impact of high rates. End of good news.

Home prices in relation to income are at an all-time high. Unless income skyrockets, homes are unaffordable to new buyers. Declining home prices will erode home equity and consumer confidence.

The number of transactions in the housing market will reset to a semi-permanent lower level. At the new, higher rates, if you sell your house and buy one next door, your mortgage payment doubles. This also impairs workforce mobility.

It’s unclear if unemployment will stay low. Tech companies have just started laying off high-earning workers; a lot more pain is likely.

This is the worst geopolitical environment is generations: war in Europe and China soon to be the largest economy but not a friend. Defense spending increases are almost a certainty.

US debt-to-GDP is 130% (the highest level since WWII) – higher interest rates will lead to more money printing to pay for higher interest payments and increases in defense spending.

Companies are choosing resilience of supply chains over efficiency. Selective deglobalization leads to higher costs – and adds to inflation.

Inflation leads to the reduction of purchasing power, lower savings, decline in production., which causes stagflation.

Higher corporate and income taxes are likely – it’s almost irrelevant who runs the country. High taxes are de-stimulative and lower growth. Higher unemployment is likely.

Possible outcomes

Inflation gradually subsides: The economy slows down a little but is still growing. Interest rates normalize at a semi-normal level. That’s a Nirvana 1.0 outcome, a garden-variety sideways market. Or event better…

Corporate margins don’t deflate but stay at current all-time high levels. That is the Nirvana 2.0 outcome. Market appreciation more or less matches the growth of the economy.

Inflation persists: Inflationary sideways market – nominal earnings growth + declining P/Es. Eventually, inflation breaks by itself through stagflation or with the help of the Fed. See next.

Inflation is broken: Economy in short-term recession – short-term bear market, long-term sideways market.

Inflation leads to deflation or long-term recession: Bear market rhyming with the one in Japan or, if interest rates go negative, shoot-the-moon bull market!

An outcome I did not think of.

To summarize the above, long-term stock market returns have two sources: earnings growth, which is under pressure for a longer list of reasons than usual + valuations, which are at historical highs and also under pressure.

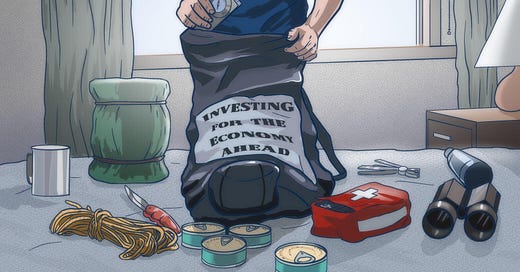

How to invest

Worry macro, this is what I did above, invest micro – this is what I’ll discuss next:

Look for companies that can survive and prosper in all of the above scenarios.

Be process-driven – the market will likely be more bipolar than usual. Know what you own, why own it, how much it is worth.

You need to have patience – wait for opportunities to come to you.

Competitive intensity will likely increase when the economic pie is not growing. Stick to high-quality companies run by great people.

Increase your margin of safety – you’ll need it.

Don’t be afraid of cash (short-term bonds) when you don’t find opportunities. Cash is better than overvalued stocks or low-quality companies – or especially the combination of the two.

Look for stocks in other markets – they expand choice greatly.

Don’t time markets; it’s impossible to put market timing into a process. Buy undervalued companies and sell them when they are dear.

“Sell” is a four-letter word in secular bull markets; it is an important practice during sideways markets.

Until my father read my book, Active Value Investing, he thought investing was a legalized form of gambling and that I should do something "real", such as open a bagel store or doughnut shop. He even offered to help. After writing this, I realized that over the next decade or two, there will be times when I wish I had taken my father up on his offer. Investing will be challenging as the stock market and economy enter a phase of repaying for the excesses of the past. I am fortunate to have a passion for investing, not bagels.

P.S. I asked IMA clients for feedback on this style of writing. Some appreciated the conciseness of the format. One client, a software engineer, suggested that I reduce the compression rate from 50:1 to 10:1. However, most felt that storytelling is what attracted them originally to my writing. I have to confess, though I enjoyed the challenge of compressing thoughts into compact sentences, the highlight of the essay for me was writing about the bagel shop.

Soul in the Game Amazon reader review:

Reading Vitaliy's essays has encouraged me to continue to think differently about my own life. I have already found myself reading certain parts more than once. It should appeal to those interested in learning to create a more rich life for themselves, their loved ones and their friends.

Introduction to Rondo

Today, I would like to share with you a wonderful short, light piece, "Introduction to Rondo," by French composer Camille Saint-Saëns (1835-1921). Saint-Saëns originally intended this piece to be the conclusion for his violin concerto but then changed his mind and left it as a standalone composition for violin and orchestra.

This is one of the most popular and frequently performed pieces for violin, and I will share with you a number of performances by some of the biggest names in the violin world. However, before you listen to the violin performances, I recommend that you first listen to Georges Bizet's (1838-1875) arrangement for two pianos. While it provides a great silhouette of this piece, it lacks the emotional punch that the violin brings to it, thus pointing up the great contrast between the emotional impact of the violin versus that of the piano. For fun – why not – I’ll add some cello, flute, and guitar arrangements.

Click here to listen.

Vitaliy Katsenelson is the CEO at IMA, a value investing firm in Denver. He has written two books on investing, which were published by John Wiley & Sons and have been translated into eight languages. Soul in the Game: The Art of a Meaningful Life (Harriman House, 2022) is his first non-investing book. You can get unpublished bonus chapters by forwarding your purchase receipt to bonus@soulinthegame.net.

Please read the following important disclosure here.

Thanks for sharing.

"Don’t be afraid of cash (short-term bonds)"

+1 - until this weekend, 6-month T-bills were yielding >5%

"An outcome I did not think of."

Inflation becomes embedded despite contined Fed rate hikes & QT. Fed eventually admits 2% inflation target is not practical. Bonds sell off and interest rates soar.

Don’t shy away from your 50,000 word letters, they have great value and give the reader a deeper understanding. Although I can appreciate your efforts to accommodate those that don’t have the time or patience to read.